The Burgess Group | Compass Boulder realtors have gathered tons of funny anecdotes throughout our careers. But, by far, this is one of my favorites:

One time a Boulder realtor here had a client ask, “Why do I keep hearing about kitty condo mortgages? Are there really special mortgage programs for cat owners? I just got a Husky puppy. Do I qualify for any special mortgage loans?”

It took us a few minutes to sort out the misunderstanding, and the trend he’d been hearing out was kiddie condos.

An understandable, but hilarious mistake.

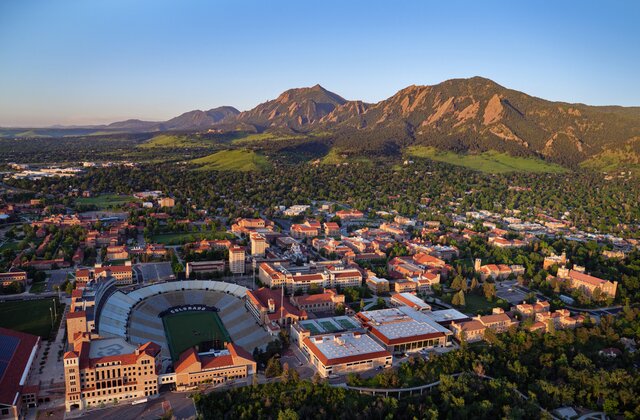

A “kiddie condo” is the term used to describe a house, apartment, or condo bought for a college student. Boulder’s housing prices are high. But Boulder rent prices are high too! The average rent in Boulder in 2022 is $2,347 for an 825-square-foot apartment. If you plan to help your child with their living expenses, why pay rent when you could purchase a property and see a guaranteed return on investment by the time they graduate?

- Boulder real estate has appreciated 106.3% in the past decade.

- Boulder home prices have risen 28.4% in 2022 alone.

But of course, there are both pros and cons to the kiddie condo option in Boulder. Our Boulder real estate agents break them down for you.

Pros of buying a kiddie condo in Boulder, CO:

It’s a great way to help your kid get set up for the “real world”

It’s tough out there for college kids. Gen Z is entering the workforce in a chaotic economy. Every day there are headlines about low wages, high cost of living, and post-grad debt-to-income ratios. When you purchase a kiddie condo, both your name and your child’s name can be on the mortgage. It can help them start building credit. If you decide to sell the home after graduation, you can use any proceeds from the sale of the house to help them pay off student loans or as a downpayment for a new home wherever they find a job.

There are unique mortgage programs for kiddie condos.

Kiddie Condo loan programs are offered by the FHA. Typically they have low down payment options. They also allow you to put your child’s name on the mortgage alongside your own to help them build credit. Your child can also take over the loan after graduation.

Opportunities for income potential

It’s very common to rent out spare rooms of the kiddie condo to other students to help pay the mortgage. This can be extra income potential for you (or for your child!). This is a good way to get help with the mortgage while also teaching your child bill responsibility and property management skills.

It’s a good study environment

It’s no secret that on-campus housing is full of distractions. CU is an active campus. There’s always something fun happening on campus. It’s too easy to get distracted from your studies. A kiddie condo will provide a quiet space for your student to focus on their schoolwork.

Kiddie Condos can help establish in-state residency for in-state tuition

If your child is attending CU from out of state, purchasing a kiddie condo can be a hack to receive in-state tuition. But there are some requirements to be aware of. In Colorado, the student must live in the home for 12 continuous months before the first day of classes each semester. The student must show intent to live in the residence permanently. A few things you can use to show intent are:

- A valid Colorado driver’s license

- Permanent address

- Ownership of a home

- Colorado vehicle registration

- Colorado voter registration

- Payment of Colorado state income taxes

Cons of buying a kiddie condo in Boulder, CO:

Students are less likely to take good care of the property

It can be a big leap of faith to trust a college student with the care of a property. It’s highly unlikely that they will treat the property with as much TLC as you would. Especially if the expectation is for your child to find roommates. It’s hard to escape your 20s without a few roommate horror stories.

Boulder is an expensive market

Although university life is thriving at CU, Boulder is not a “college town” per se. For this reason (and many others) it’s much more expensive to buy a home here. Our Boulder realtor team can attest to the fact that it’s one of the most expensive housing markets in the country, and the barrier to entry is high.

What’s your scholarship situation look like?

Kiddie condos are only a good idea if you’re already paying top dollar for on-campus housing. If your student has scholarships that help with campus living expenses, it may not be the best option for you.

They’ll be less connected to student life

Living on campus means that your student will be immersed in student life. There are fewer “quintessential college experiences” to be had. Living off campus means dealing with a commute, parking, and missing out on impromptu blanket-hang sessions on the lawn.

Say goodbye to summer break with your child

In-state tuition requirements state that your child must live in the residence 12 months out of the year. That means that your child won’t be able to come home for a few months during summer break. This can be a tough reality to accept. You’ll feel the impact of empty-nester syndrome.

Where to look for college student housing near CU:

Boulder has so many incredible neighborhoods that it can be hard to know where to start when house hunting. Here, our Compass Boulder realtors list 5 neighborhoods are the most hospitable to student life:

- The Hill

- East Aurora

- Goss Grove

- North Boulder

- Martin Acres

The university recognizes the student presence in these neighborhoods. They sponsor regular block parties to bring the community together. These events feature free food, live music, and games.

Ready to start searching for a kiddie condo for your CU student?

The Burgess Group | Compass Boulder realtors can help! Many of our Boulder real estate agents are CU alumni and are very familiar with the best locations for off-campus student housing. Please reach out to Catherine and Andy Burgess directly at 303-506-5669.