Unexpected win for both buyers and sellers: mortgage rates have dipped under the proverbial limbo bar again. The Federal Reserve surprised pundits last month by continuing their bonds and mortgage-backed securities purchases. Long expected to taper off this fall, this program will likely be in place until the next Fed meeting in December or longer. Additionally, the government shut-down has likely affected mortgage rates. Freddie Mac’s chief economist Frank Nothaft believes that declining consumer confidence also depressed rates. The result: mortgage rates are significantly lower than the recent high of 4.57%. Average 30-year fixed loans

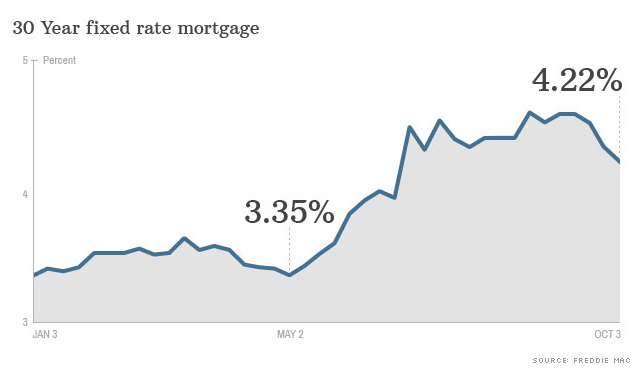

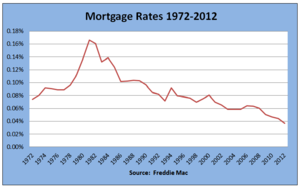

Unexpected win for both buyers and sellers: mortgage rates have dipped under the proverbial limbo bar again. The Federal Reserve surprised pundits last month by continuing their bonds and mortgage-backed securities purchases. Long expected to taper off this fall, this program will likely be in place until the next Fed meeting in December or longer. Additionally, the government shut-down has likely affected mortgage rates. Freddie Mac’s chief economist Frank Nothaft believes that declining consumer confidence also depressed rates. The result: mortgage rates are significantly lower than the recent high of 4.57%. Average 30-year fixed loans dropped from 4.32% to 4.22% last week. It is anticipated that rates may creep up as we get closer to December’s Fed meeting. Rates will also be affected by the duration of the government shutdown. How will buyers benefit? Buyers can get more house for less money for possibly 45 days or so. How do seller’s benefit? Motivated buyers are looking to get into contract before rates change. Even at recent peaks, current mortgage rates are at historic lows. Whip out your magnifying glass to read the chart below; mortgage rates have rarely been close to 6% within the past 40 years.

dropped from 4.32% to 4.22% last week. It is anticipated that rates may creep up as we get closer to December’s Fed meeting. Rates will also be affected by the duration of the government shutdown. How will buyers benefit? Buyers can get more house for less money for possibly 45 days or so. How do seller’s benefit? Motivated buyers are looking to get into contract before rates change. Even at recent peaks, current mortgage rates are at historic lows. Whip out your magnifying glass to read the chart below; mortgage rates have rarely been close to 6% within the past 40 years.  If you are a buyer, it is likely that these are some of the best rates you’ll see in your lifetime. Sellers, don’t forget that the winter slow-down is around the corner. Take all offers seriously. Read the Original Article Here: Home mortgage rates drop again

If you are a buyer, it is likely that these are some of the best rates you’ll see in your lifetime. Sellers, don’t forget that the winter slow-down is around the corner. Take all offers seriously. Read the Original Article Here: Home mortgage rates drop again

How Low Can They Go? Mortgage Rates Limbo Lower