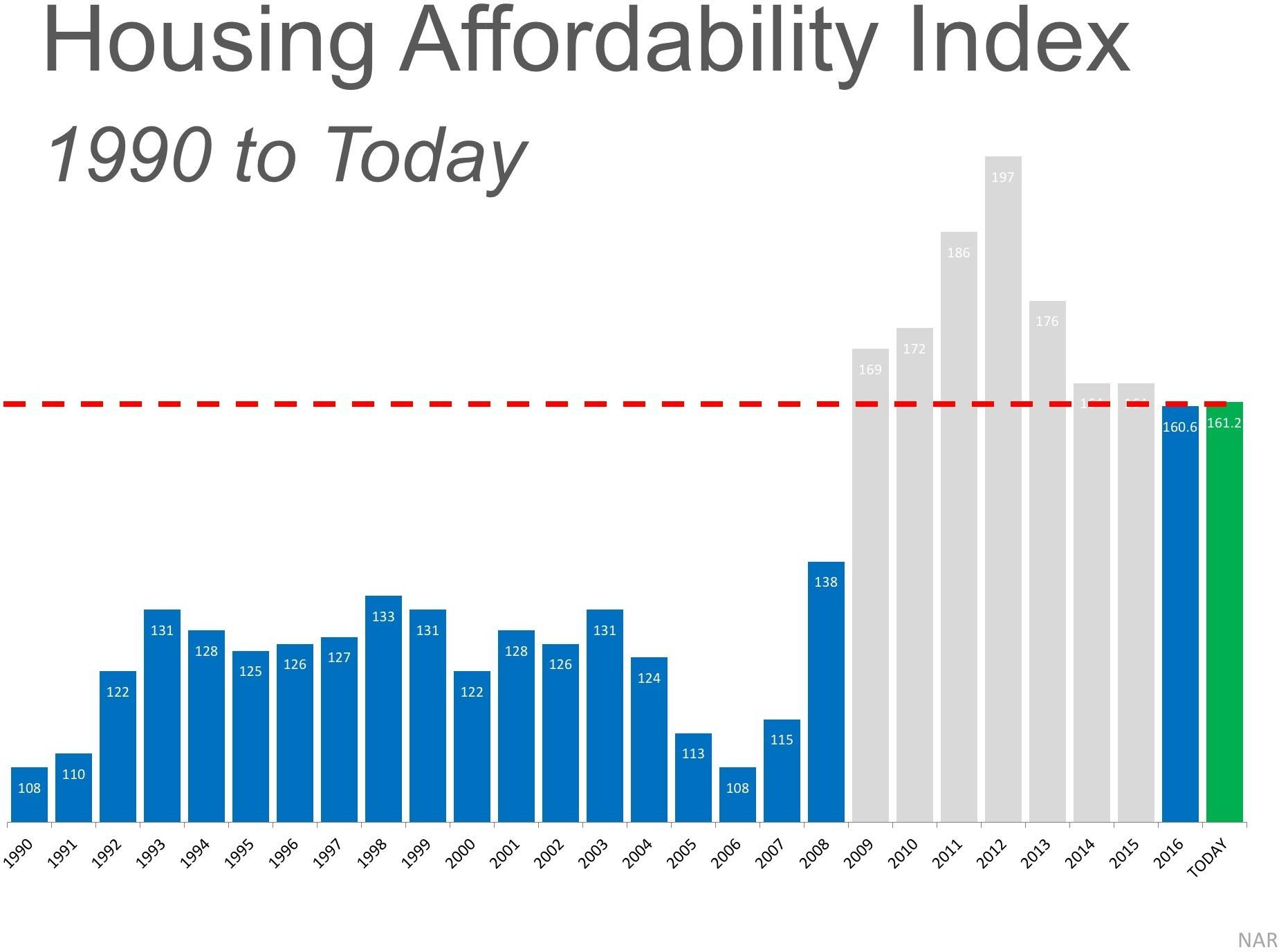

The National Association of Realtors (NAR) established the Housing Affordability Index as means of predicting trends in the housing market.

Recently, there has been a cause of worry for people who want to buy a house because of this established indicator.

What is Housing Affordability Index?

NAR uses the Housing Affordability Index to grade the ability of an average family to be qualified for a mortgage loan based on their income.

A value of 100 is the value of the Housing Affordability Index where the average family can afford to mortgage a home.

Above 100 means that they have a surplus or abundance that makes them even more qualified.

The prediction of the Housing Affordability Index is approaching a downward trend for 2017.

Some experts in the industry believe that this indicates higher prices of homes and a spike in the interest rates of mortgages.

Recognizing the Context for the Downward Trend

There is now widespread worry about this news that people will no longer have mortgage power.

The good news is that there is a context behind this phenomenon.

The index soared in value between 2009 to 2013. It was full of foreclosures and short sales which caused price drops and major discounts to sold properties.

This year’s index rate is part of the recovery or corrective process of bouncing back from the 2009 to 2013 index crisis.

Looking at the big picture and taking out those years of crisis from data starting 1990, we will find that there is no reason to worry.

At this point, while home prices are increasing, so is the income of the average family according to the Q1 2017 report of ATTOM Data Solutions on the Home Affordability Index.

Even if the index is showing a negative downward trend, it is still a great time to buy real estate.

At Burgess Group Realty LLC, we help our clients find their best options in the market. Let’s meet up so we can help you with your options in buying your dream home.

CALL Catherine at 303.506.5669.