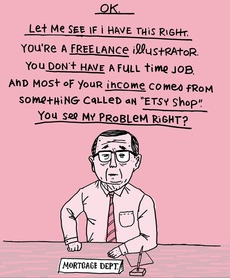

Is it an enormous annoyance to pull together documentation for a home loan? Heck, yeah. But what is the alternative?

Buyers, if you fail to provide everything your lender needs right off the bat, you are waylaying your loan, wasting precious days that could cause you to fall out of contract. Yes, the quantity of documentation that your lender needs is outrageous. Fannie Mae and Freddie Mac regulations currently require documented redundancy for all income and assets. But the irritation of having to provide every original page – even those “intentionally left blank” – will fade as soon as you cross the threshold of your prized new home.

Buyers, if you fail to provide everything your lender needs right off the bat, you are waylaying your loan, wasting precious days that could cause you to fall out of contract. Yes, the quantity of documentation that your lender needs is outrageous. Fannie Mae and Freddie Mac regulations currently require documented redundancy for all income and assets. But the irritation of having to provide every original page – even those “intentionally left blank” – will fade as soon as you cross the threshold of your prized new home.

Get preapproved before you start looking. In a strong seller’s market, preapproval adds depth to an offer, as it documents that you really can buy the house. Sellers prefer cash offers, then preapproved offers, and lastly prequalified offers. Why? Cash offers can close faster and do not have a loan contingency – one fewer (significant) contingency that can derail the sale. Offers with a  preapproval letter show the seller that the buyer has sufficient documented assets and income to afford the house. Prequalification means virtually nothing; there is little to no documentation of assets and income required.

preapproval letter show the seller that the buyer has sufficient documented assets and income to afford the house. Prequalification means virtually nothing; there is little to no documentation of assets and income required.

To Get Preapproved, Cowboy Up and Get These 17 Documents to Your Lender:

- Original paystubs for the past 30 days (showing year-to-date earnings, name, and social security number)

- Most recent two years original W2 forms

- Most recent two years tax returns (with all schedules)

- Most recent IRA/Keogh/401K/profit sharing statements

- Award letter and copy of most recent check (for Social Security, retirement, or disability)

- Year-to-date profit and loss statement/current balance sheet (if self-employed)

- Residence history (addresses and dates for last two years)

- Statements on all outstanding loans/credit cards (most recent)

- Bank statements for all accounts (bring two months documentation to prove the source)

- Transcript or diploma if you were a student in the last two years

- For real estate you currently own, bring addresses, loan information, and leases (if applicable)

- Landlord’s name, phone number, address and cancelled rent checks for the last 12 months

- Relocation agreement (if you are being transferred to the area by your employer)

- Bankruptcy papers including schedule of creditors and discharge papers (if applicable)

- Check for appraisal and credit report fees

- Sales contract (for purchase of new home)

- Sales contract (if selling your present home)

Expect to provide documents according to the dictates of your personal situation. For example, if your trust is part of assets or income used to secure this loan, expect the lender to need trust documentation.

Good luck on your loan journey – get it done!

The list above was provided by Kenneth Flowe, loan officer at Colonial National Mortgage. He can be reached at 720.317.7230

Love Where You Live: The Boulder Real Estate Blog