Friends,

Last week, our numbers made a small post-Thanksgiving resurgence. More good news: foreclosures will likely have a small impact on the housing market post forbearance.

(Keep scrolling to read our new blog series “Five Questions With…” and learn more about the personal lives of the Burgess Group Team!)

Weekly Market Update Video

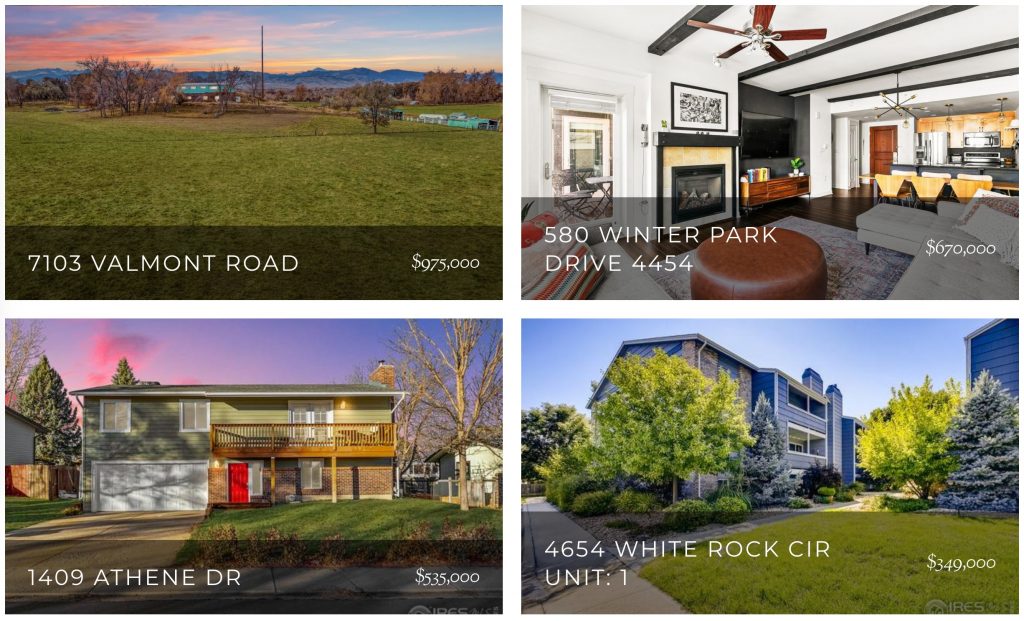

Our Exclusive Listings

Click below to check out our current Burgess Group listings.

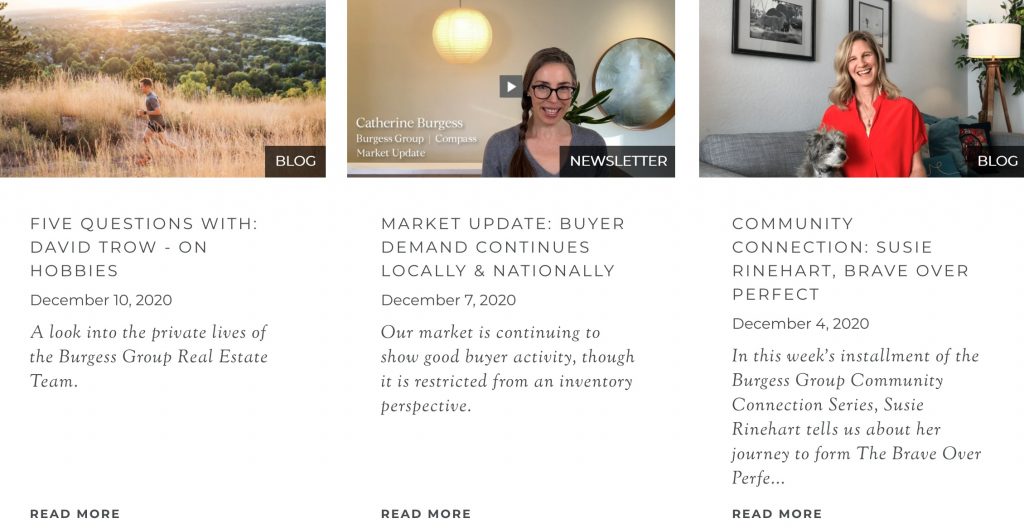

Five Questions With…

Our new blog series, “Five Questions With…” will introduce you to the diverse set of humans who make up the Burgess Group Real Estate Team.

David Trow bravely stepped up to answer the first “Five Questions” which will shed light on the hobbies our team members pursue when they’re not serving our clients as Real Estate experts.

Click here to learn how David began his life as an ultra-runner, and how this hobby elevates his Real Estate Career.

(Next week, we’ll hear about the hobbies of Andy Burgess! Stay tuned!)

You might remember David Trow’s Faces of Louisville & Lafayette interview with Lafayette local voiceover artist, Jonathan Hanst?Well, we’re here to bring you an update.

You might remember David Trow’s Faces of Louisville & Lafayette interview with Lafayette local voiceover artist, Jonathan Hanst?Well, we’re here to bring you an update.

Over the course of the pandemic, Jonathan has seen a rising need in our community. He believes that the demands and challenges of our world call for more art, love, creativity and connection…and all of us at Burgess Group | Compass agree.

Watch this video to find out about Jonathan’s plans to build a non-profit art incubator which will welcome artists of all abilities to experience the joy of creativity.

Like a coworking space gives people a chance to get out of their home offices, Kaleidoscope is designed for artists to connect. Studios will be offered on a sliding scale basis for drop in or regular use. Artists will have the chance to display their work, collaborate with each other, and render the entire property a dynamic, ever-changing canvas.

If this vision speaks to you — please consider donating. We believe the world needs more ART, and we hope you do too.

Burgess Group Blog

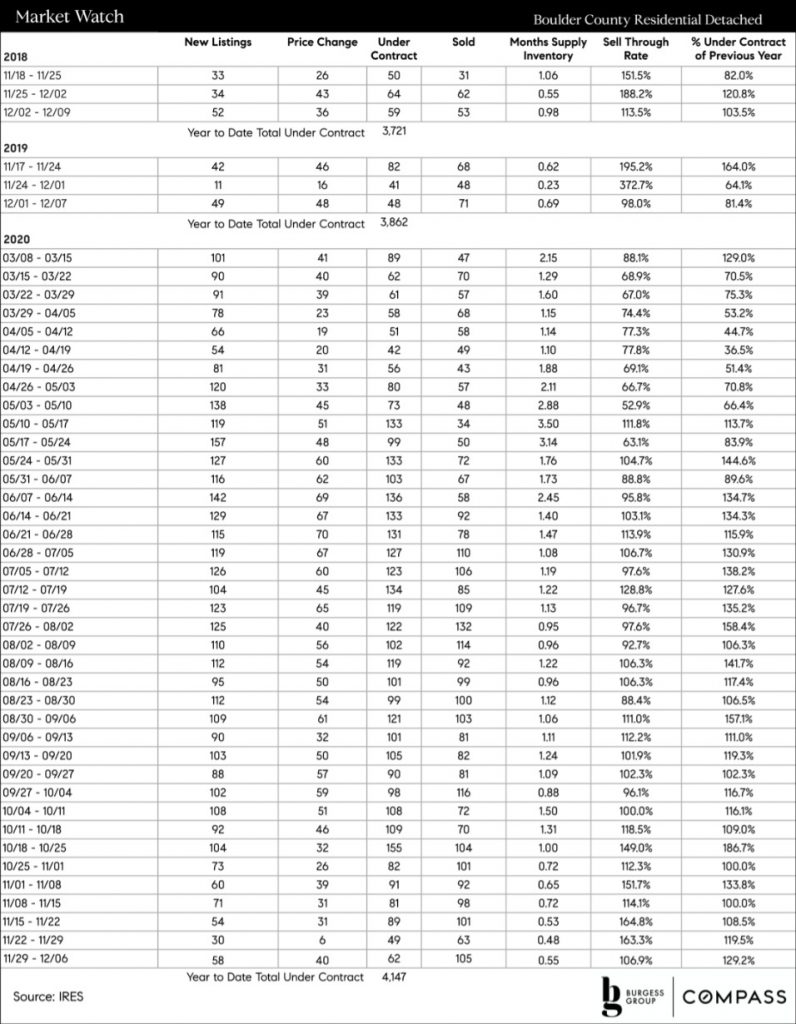

Boulder County Micro Real Estate Data

Boulder County Stats 11/29/2020-12/06/2020

THE AGGREGATE MARKET

After slowing over Thanksgiving, the market picked up again last week, with 9 units of inventory and 14 under-contracts beyond the 2019 numbers year over year (YoY).

Remember, we focus on under-contacts is because they are a coincident indicator. Solds are not as relevant, as they are a lagging indicator, showing what the market was doing 30-45 days prior. FYI, in the broad economy, builder housing starts are considered a leading indicator, showing builder confidence (or lack thereof) in the economy/future buyer demand many months before their new housing inventory hits the market.

Interestingly, in our local tight seller’s market, price changes are now in fairly close alignment with 2019 price change rates. In recent months, sellers were not making the price reductions at typical rates of the past 5 years.

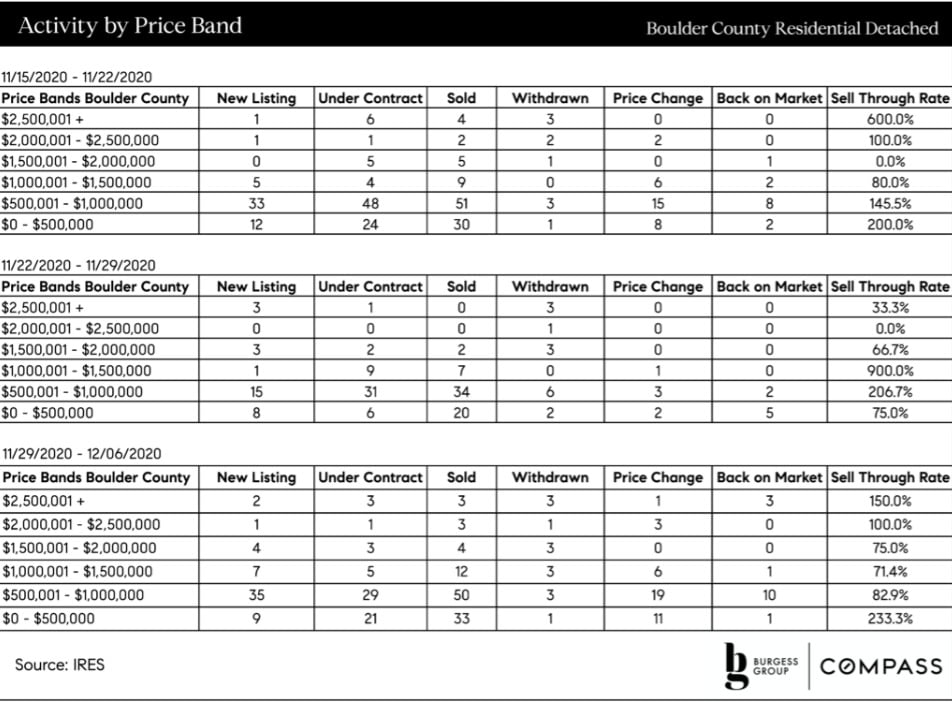

THE MARKET BY PRICE BAND

Listing inventory in the $500-1mm price band increased 20 units week over week (WoW), with under-contracts staying steady. Hopefully this is gave a little relief to buyers in this category. The $0-500K band saw only 9 new listings with 21 under-contracts, creating a 233% sell-through rate, whittling down inventory in that section.

All other price bands reflected a healthy market, with the $1mm-2mm bands having more (needed!) inventory come than properties go under contract.

Local Real Estate in a Nutshell

We are on repeat!

Buyers, hang in there. Work with someone experienced who is deeply knowledgeable about how to use the contract to your advantage to get you a home. Call us about the strong buyer-opportunities that exist out there.

Sellers, now is the time. The sooner you can come to market, the better. While there are big unknowns the further out we look in 2021, in the next 3-6 months, hopefully the housing market will continue to bring ready buyers to your home.

National Macro Data

IMPACT OF FORBEARANCE TO FORECLOSURE

Will mortgage forbearance ending turn into a flood of foreclosure inventory in 2021?

Experts predict that the upcoming housing market will look vastly different from the housing crisis of 2008.

In general, homeowners today have enormously more home equity than they did in 2008. At that time, the average homeowner had 6% equity. Because there was so little equity, many houses went into foreclosure when the sellers ran into economic challenges.

This year, homeowners have a national average of 30% equity, meaning that they have 10% more equity beyond the typical 20% down that lenders like to see. If they run into economic challenges, they can dip into this equity as needed. Lenders are also willing to work with borrowers in a number of new ways, making the predicted number of foreclosures even smaller.

It is anticipated that upcoming foreclosures numbers will be so small that they will not noticeably impact the national dearth of housing inventory.

The top of the chart below shows the areas with the least home equity nationally, showing more equity as you move down the chart.

Mortgage rates set 14th record low of the year, driving even more refinance demand

Job Openings Slowing in Construction

Next stimulus package may include eviction moratorium and $25 billion in rental assistance

Economic growth will be better than expected thanks to the resilient services sector, Goldman says

Boulder County COVID Testing

The Stazio Ballfields off 63rd and Stazio reopened for drive-up COVID-19/other tests. It can be very efficient, quick, and easy to pre-register online.

The Fun Stuff: All I Want For Christmas Is You (COVID PARODY) | YVR POP CHOIR

CATHERINE BURGESS

CATHERINE BURGESS

Associate Real Estate Broker

303.506.5669

[email protected]

Associate Real Estate Broker

303.301.4718

[email protected]

© Compass 2020 ¦ All Rights Reserved by Compass ¦ Made in NYC

Compass is a licensed real estate broker and abides by Equal Housing Opportunity laws. All material presented herein is intended for informational purposes only. Information is compiled from sources deemed reliable but is subject to errors, omissions, changes in price, condition, sale, or withdrawal without notice. No statement is made as to accuracy of any description. All measurements and square footages are approximate. This is not intended to solicit property already listed. Nothing herein shall be construed as legal, accounting or other professional advice outside the realm of real estate brokerage.