If you look at the recent news articles, it will seem like mortgage has taken a turn for the worst.

Interest rates climbed from 3.42% to 4.1% last September according to Freddie Mac.

At first glance, this may seem like very bad news.

The MCAI Silver Lining

The reports failed to mention an interesting detail which is a silver lining to the rate increase: requirements for mortgage applications have become much easier and friendlier.

There are times in the past where it costs an arm and a leg to get a new mortgage going.

There are other indicators at play which affect the landscape of real estate.

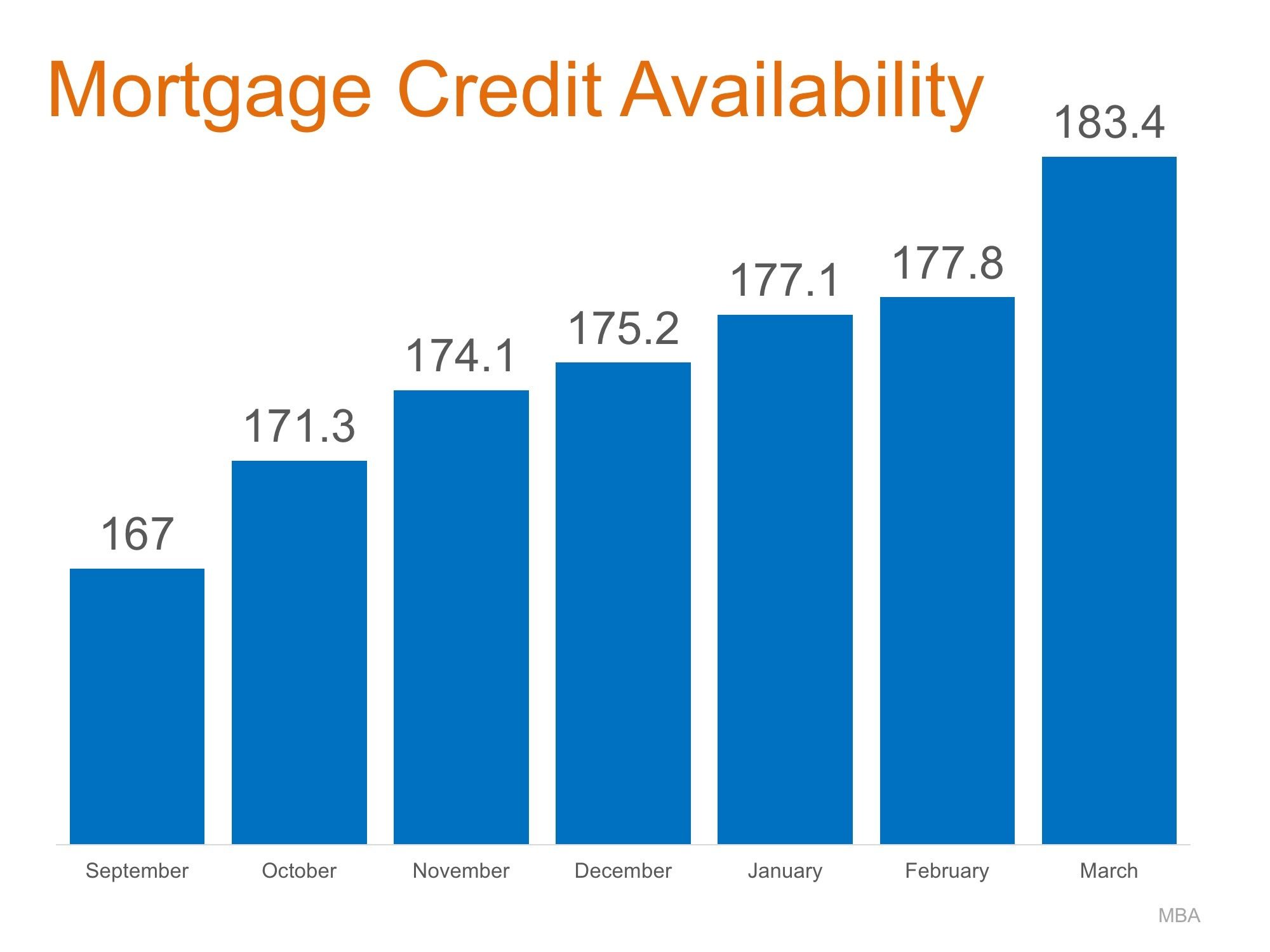

The Mortgage Credit Availability Index (MCAI) set up by the Mortgage Bankers Association (MBA) is a reliable indicator of mortgage credit’s availability at any given time.

Higher MCAI values mean easier mortgage application for people.

It indicates a relaxing of requirements for home buyers.

As mortgage rates recently increased over the months, so did the MCAI value.

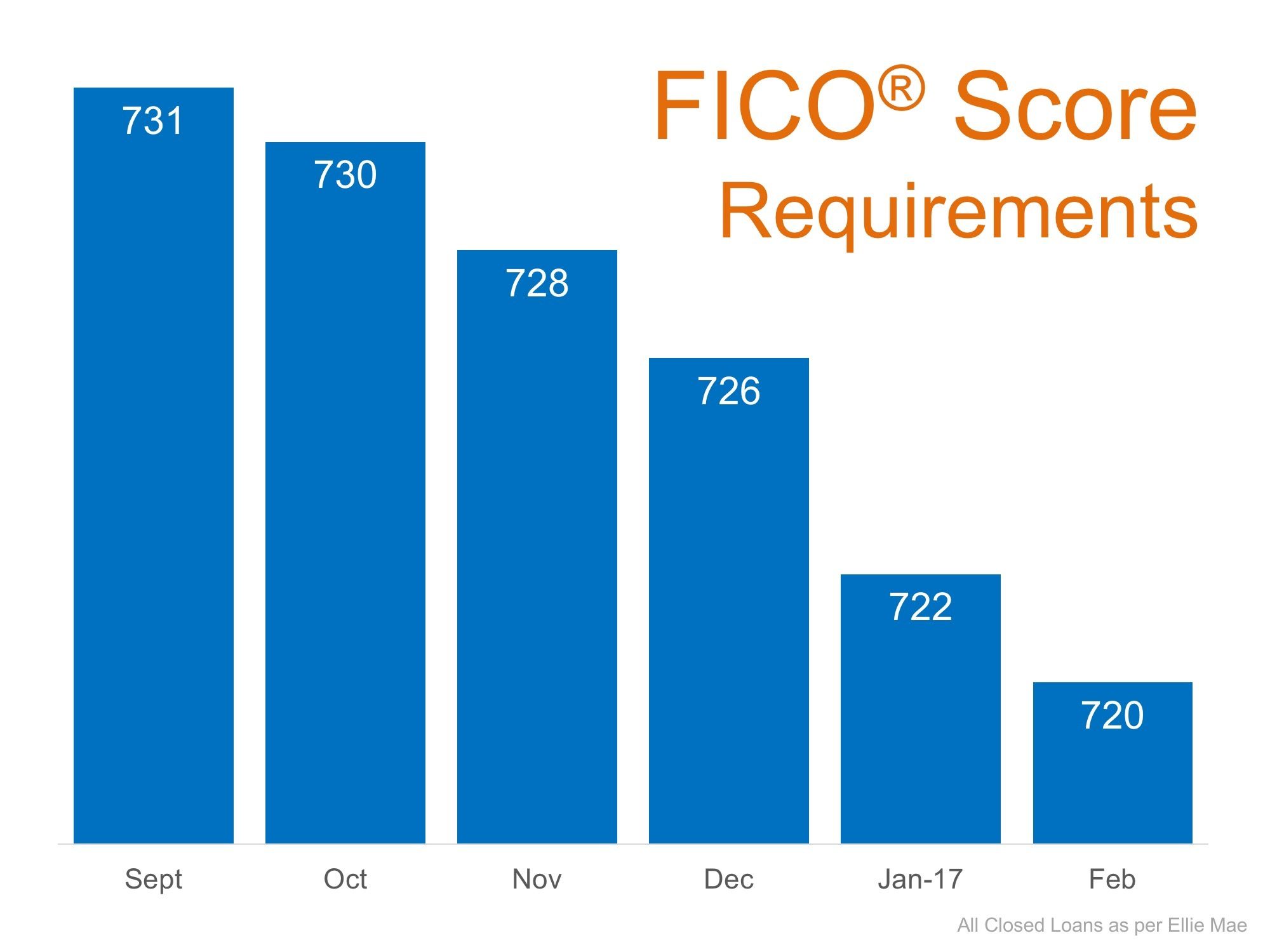

FICO Score and Down Payment Implications

The FICO score minimum for a buyer of homes decreased over a five-month period.

The required down payment for a home also decreased.

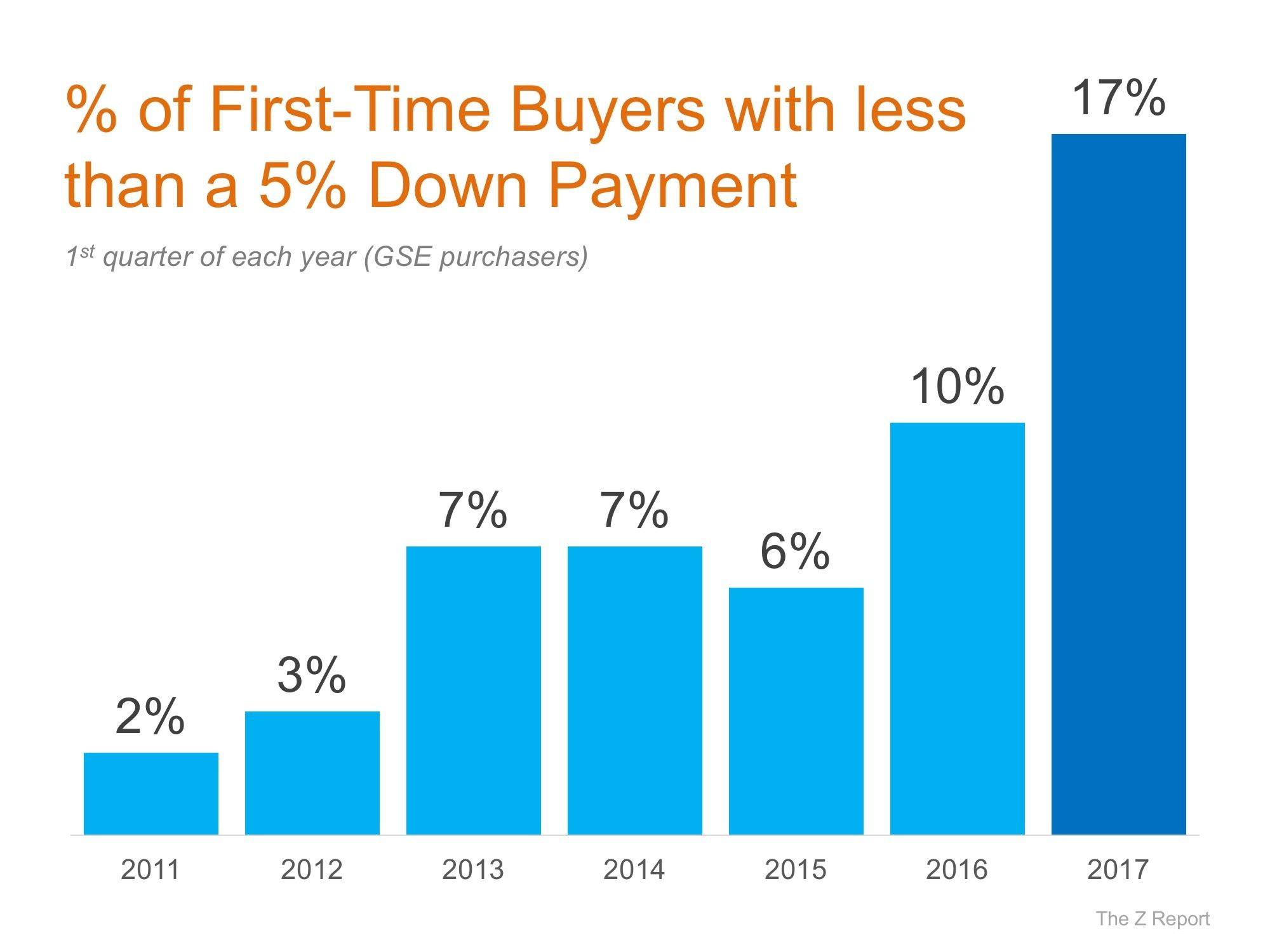

For Q1 of 2017, more people are able to pay a down payment that is as low as 5% (or less) of the total price.

This is a very promising prospect for people who wish to buy a home.

Getting a mortgage is easier today than it has been in any other time in the last ten years.

At Burgess Group Realty LLC, we help our clients secure the best deals in the market today.

Let’s meet up so we can help you find your home whether you’re looking to move to a home that will serve your family’s need or you’re looking for a home for the first time,

CALL Catherine at 303.506.5669.