Getting a home mortgage loan is often a cause of worry for most people in America according to an Ipsos survey.

It is popular and paved with good but misguided intentions.

There are simply too many myths surrounding the capacity down to buy a new home.

Aside from the common doubts nursed by a home buyer, there are misconceptions to consider.

Two myths need to be debunked, primarily.

FICO or Credit Score

The myth on credit score causes the highest dent in consumer self-confidence.

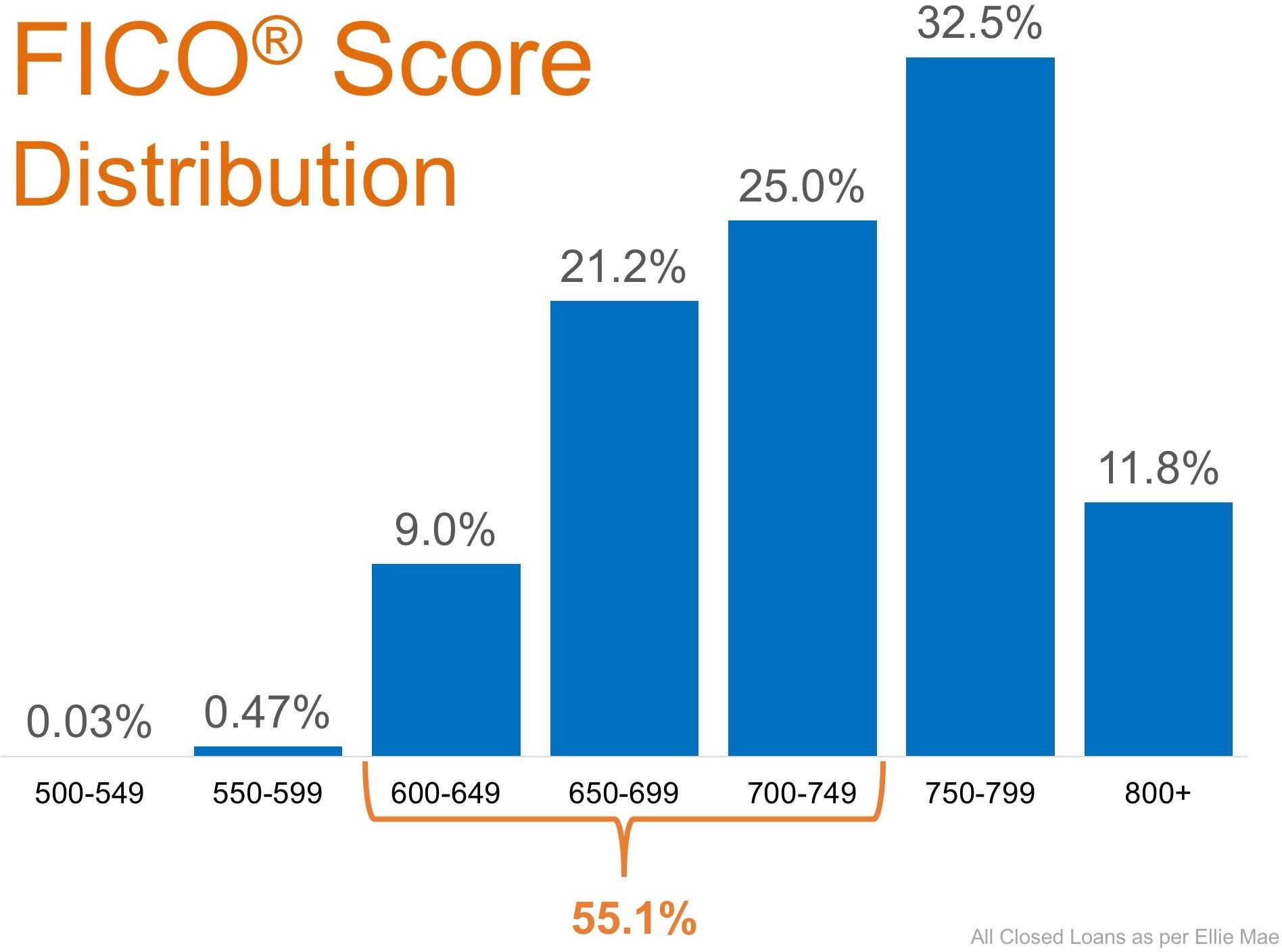

Most people are inclined to believe that an excellent FICO score is a necessity.

Countless surveys reveal that this is a common perception. Some even peg a minimum score of 780.

However, people with lower scores like 686 get approved in real life.

FHA loans approve an average FICO score of 720.

This lowers the bar considerably and makes the housing market more encouraging.

Overestimation of Down Payment Requirements

A lot of people expect to make a 20% down payment for getting a mortgage home loan.

Almost half or 40% of people surveyed believe this to be true.

These days, there are already programs that allow for less spending of initial cash for a home.

Aside from this, some traditional housing market agreements allow as low as 3% initial down payment.

Still confused? Fortunately, there is expert help available for you as you go through this.

If you are planning to buy your home but not sure if you are able to, let’s meet to help you understand your true options.

At Burgess Group Realty LLC, we help our clients find the best deals in the market. Let’s meet up so we can help you buy your dream home.

CALL Catherine at 303.506.5669.